|

|

|

|

|

FINANCIAL OVERVIEW

| Year |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Annual Assessments

Special Assessments

------------

Total

Increase

|

$996

-

------------

$996

*2.5%

|

$1,024

-

-----------

$1,024

2.8% |

$1,088

-

----------

$1,088

*6.3% |

$1,088

-

----------

$1,088

0%

|

$1,264

-

----------

$1,264

*16.2%

|

$1,264

-

----------

$1,264

0%

|

$1,416

-

----------

$1,416

12%

|

|

|

|

|

*2015 |

Includes special project of 4 new very large trees to replace lost trees.

|

|

*2017 |

Includes funds to build a package center (note: cost of mailboxes already included in capital budget)

|

|

*2019 |

Includes funds to add security camera (2019) and an exit gate (2020)

|

|

*2020 |

Includes funds for an exit gate (2020) and to cover budget overrun in 2019

|

|

*2021 |

Estimated 2021 rate pending HOA vote. Includes coverage of unpaid assessments. |

| Year |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Capital Reserves Bal.

Self Insurance Bal.

------------

Total Year End Balances

|

$99K

$17K

------------

$116K

|

$113K

$17K

-----------

$130K

|

$34K

$17K

----------

$51K

|

$45K

$17K

----------

$62K

|

$64K

$16K

----------

$80K

|

$87K

$16K

----------

$103K

|

$100K

$17K

-----------

$117K

|

|

|

|

|

|

Includes land sale to TxDOT $25K

|

|

*2016 |

Includes collection of past due assessments in excess of $11K

|

|

*2017 |

Capital expenditures include roadway ($50K), package center & doors ($16K), garage foundation & walls ($12K), and community fence ($2K)

|

|

*2018 |

Capital expenditures include roadway ($6K). Note: additional $5K in dispute with contractor.

|

|

*2019 |

Emergency reserves reserve tapped to repair water main leak

|

|

*2020 |

Capital reserve invested in mutual fund earning $13,500

|

| Year |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|

Cash balance at year end after paying bills

Unpaid bills

------------

Total

|

$5K

K

-----------

$5K

|

$33K

-$28K

------------

$5K

|

$5K

K

-----------

$5K

|

$9K

K

----------

$9K

|

$2K

K--$4K

----------

-$2K

|

$24K

K- -$36K

----------

-$12K

|

$0K

K- -$24K

----------

-$24K

|

|

|

|

|

*2015 |

House painting late in year (invoice not paid) and disputed utilities.

|

|

*2019 |

Delinquent dues doubled. House painting late in year - invoice not paid.

|

| Year |

2017 |

2018 |

2019 |

2020 |

2021 |

|

| Unpaid Owner Assessments |

$8K

|

$9K

|

$22K

|

$20K

|

|

|

|

|

|

*2017 |

Reduced collections by another 28%. All delinquent owners on payment plans

|

|

*2018 |

80% of delinquency is 3 homeowners owing more than a year and that will not pay - liens filed

|

|

*2019 |

245% increase in delinquency.

|

Reserve Saving/Spending Schedules

The Association is required to maintain a Capital Reserves and the Emergency Reserves. The Capital Reserves are retained in a brokerage account and are only for capital infrastructure repairs as specified in the reserve study and with each release approved by a vote of owners. The Emergency Reserves are self insurance for those assets of the Association that cannot be insured by commercial insurer (e.g. water main break). The Emergency Reserves are retained in a Money Market account at North Dallas Bank and funds may be released by a vote of the board for emergency purposes.

The capital reserve rate is set in the reserve study which was approved by a vote of owners. The annual reserve rate, which is an allocation of Association assessments, is as follows:

| Item |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Annual Capital Savings

|

$12.0K

|

$12.7K

|

$13.5K

|

$14.3K

|

$15.0K

|

$16.0K

|

$17.0K

|

A reserve study was completed and approved by the board in 2010 and approved by a vote of owners in January 2011 (96% to 4%). The study concluded that the Association had a dangerously underfunded reserve. The 2010 annual reserve rate was a startup rate of $5,000 year. A reserve study was completed and approved by the board in 2010 and approved by a vote of owners in January 2011 (96% to 4%). The study concluded that the Association had a dangerously underfunded reserve. The 2010 annual reserve rate was a startup rate of $5,000 year.

The Association had a windfall contribution in 2011 of $25,000 for the sale of land to TxDOT.

A revised report was approved in 2019 (84% to 16%) that set an annual rate of $12,000 in 2018, increasing at 6% each year.

Annual Budget - 2021 (Draft)

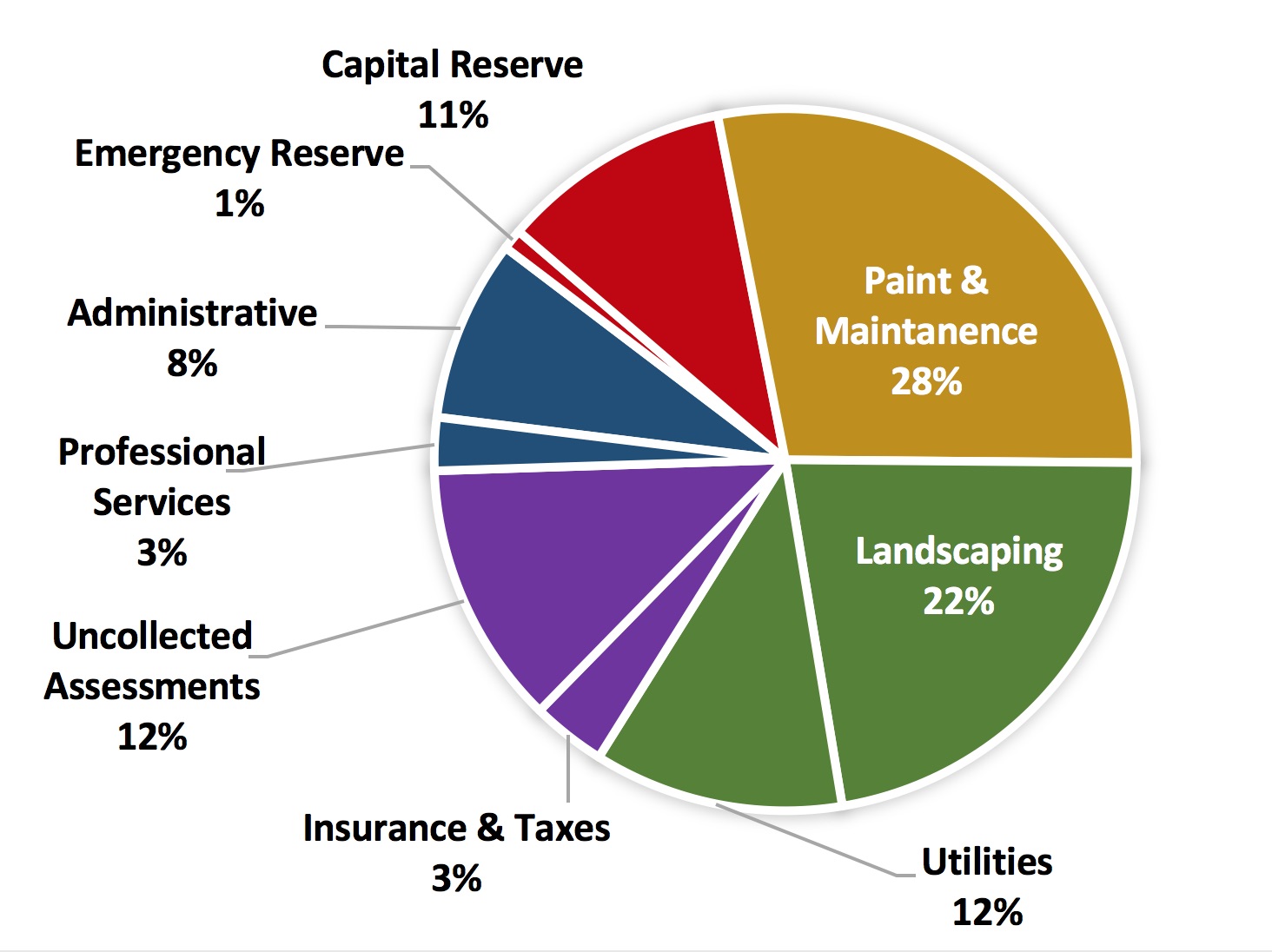

| Landscaping |

|

Landscape services are provided by Steven's Landscaping (lawn mowing, hedge trimming), Chemlawn (fertilization, weed control), Maya Tree Service (tree trimming from ground to crown), Waterboy (maintenance of the irrigation system) and the City of Irving (water). This also includes the community flower beds.

Landscaping services do not include replacement shrubs, grass, flowers, bed edging, pest control or tree removal on individual homes. Services are not provided to fenced in yards. |

|

|

|

| Painting & Maintenance |

|

Services are provided by Elite Painting and include painting and repair of siding and trim (up to a cap level of $850) and replacement of light bulbs and electric eyes associated with the front yard pole lamps (volunteers).

These services do not include painting or siding repairs between paint cycles. |

|

|

|

| Reserves |

|

Capital Reserves Mandatory annual reserve provided/required in the CC&R (bylaws) that is collected at a rate approved in 2018 and modified in 2018 based on reserve studies. Include the often very expensive repairs to roads, walls, garage roofing/doors/ infrastructure, sewer and water lines, and storm drains. These are expenses can run between $8,000 - $75,000. Spending of the capital repairs requires a vote of approval by the owners before funds are released from the repair reserve savings. In 2017, the Association purchased $55,000 in services from Pavecon (concrete road repairs) and Delta (traffic spikes).

These services do not include "real time" or "on-demand" repairs except for emergency conditions like water main or sewer breaks.

Emergency Reserves Mandatory self insurance fund reserve provided/required in the CC&R (bylaws) that must be maintained at a level of $17,000..

|

|

|

|

| Insurance |

|

The community insures the common grounds including streets, walls, the 2023 garage, and all pipelines. All items are insured by either a commercial insurance policy with Philadelphia Insurance Companies, who specialize in HOAs, and by a $17,000 cash reserve held to cover items that can not be insured (e.g., water mains).

|

|

|

|

| Taxes |

|

Property and income tax. |

|

|

|

| Administration |

|

Association accountant collects assessments, pay bills, and maintain records.

Problems with Guardian developed since a change in personnel in 2019. After 1 year, problems have not resolved and the Association will need to hire a new accountant in 2021. Expenses are expected to double as Guardian contract was well below market rates. |

|

|

|

| Professional |

|

Julie Blend, Esq,, attorney/collections, Timothy and DeVolt, auditors, and the credit card vendor fee, and online-services.

|

|

|

|

| Non-reoccuring expenses |

|

Uncollected Assessments A one time charge to cover the cash shortfall dating back to 2019 which is causing the Escalation to run out of money each year. |

Budget Detail:

Current Budget and Monthly Spending Reports

Click on icon to view

Click on icon to view

Federal and State Taxes

The Beverly Oaks Homeowners Association files federal taxes as an IRS 528 corporation. The IRS describes "528" as a "quasi not-for-profit" class - a for profit corporation with some special considerations. The primary consideration is that the Association can have dues income without paying tax on it. Beverly Oaks has elected this status since 1983. The Association does not have a 501(c) (4) not-for-profit, Federal tax exempt designation letter. The Association has not been issued a sales tax exemption from the state. The Association is not exempt from paying property taxes.

The Association does qualify franchise tax exemption and filed for this exemption in 1987. The Association is required to report to the State every four years to maintain this status.

The Association pays property tax on the roadway, storage garages, cul-de-sac gardens and mailbox peninsulas. The property has been given a nominal valuation of $22,000 in 2009 even though the improvements have a replacement cost of $1,500,000 (road/water lines/sewer).

FEDERAL TAX FORMS 1099 should be prepared and mailed to all contractors by January 30;

FEDERAL TAX FORMS 1096 should be prepared and mailed to IRS listing all 1099’s mailed by January 30;

FEDERAL TAX FORM 1120H should be prepared and mailed to IRS March 15.

Audits

The association shall, as a common expense, annually obtain an independent audit of the records. Copies of the audit must be made available to the unit owners.

An audit required by this subsection shall be performed by a certified public accountant if required by the bylaws or a vote of the board of directors or a majority vote of the members of the association voting at a meeting of the association.

PROPERTY CODE, TITLE 7. CONDOMINIUMS, CHAPTER 82. UNIFORM CONDOMINIUM ACT, SUBCHAPTER A. GENERAL PROVISIONS, Sec. 82.001. SHORT TITLE. This chapter may be cited as the Uniform Condominium Act. Added by Acts 1993, 73rd Leg., ch. 244, Sec. 1, eff. Jan. 1, 1994.  Link to Property Code Link to Property Code

|

|

|